In the market system, there is an opinion that the government is a referee and the others are the player. As a referee, government ideally only regulates or supervises the market system. This concept aims to reduce the possibility of government dominance or "monopoly" in the market and bolster healthy competition. However, in some cases, the government should participate in the market through "its extension", such as state-owned enterprises or government agencies. So, what if the government also becomes the market player, at the same time, the referee. Is there any conflict of interest? This topic is growing and might need a long discussion or research to elaborate on it. This paper will only discuss a small part of how far the government should participate in the market, in particular in providing leased assets.

There are two circumstances of why the government might consider entering this market. Firstly, the supply side is limited. It means that there is insufficient supply from the private sector in fulfilling the leased asset demand. Secondly, the demand side cannot compensate for the relatively high prices for leased assets. Both conditions refer to market failure. Hence, how far the government should participate depends on how significant the market failure is.

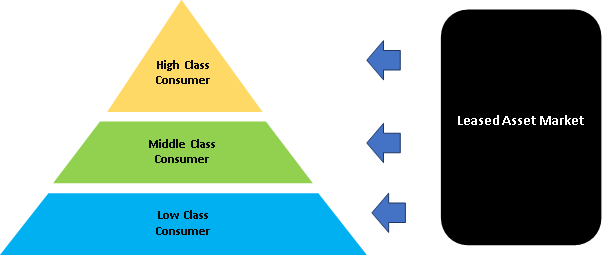

Firstly, we need to cluster the demand and supply sides. The asset market for the high-class consumer might be less problematic. The supply and demand sides are relatively balanced. Nevertheless, the middle-low-class level might encounter the demand-side capacity problem. The quantity demanded is high, but the capability to buy is low. Therefore, the government indirectly intervenes on the demand side, e.g., via soft credit for small-medium businesses.

Simultaneously, the pandemic COVID-19 has reformed the working culture from the work from office to the work from home. This change implies that the necessity of physical assets for the government decreased. The government state assets might be potentially underutilized in the future. Therefore, the supply of potentially leased assets from the government might increase. By regulation, the effort to develop a leased government asset catalog for a commercial purpose is also possible.

However, another challenge is identifying middle-class consumers and making them know the list of leased government assets. The central government (DGSAM) might need to collaborate with local authorities, such as provincial or district government and village officials, in promoting the leased government assets to middle-class consumers, such as small-medium enterprises (SMEs). It is essential to ensure that the underutilized state asset is prioritized to fulfill the local SME's demand. This collaboration strategy might enhance the occupancy of an underutilized government asset, at the same time, handle the market failure in the leased asset market.

Nevertheless, we have to be careful because it might also imply the "disruption" of the market if the supply of the leased asset from the private sector is excessive. Therefore, the regional property market demand and supply analysis is a must. We should clarify the cause of excessive supply, whether the low purchasing power drives it or not. Therefore, an asset optimization policy is not one-fit-for-all. Some regions might need underutilized government assets to fill the gap of leased asset supply or to tackle the low purchasing power in the middle-low class consumer. Meanwhile, others might need to optimize the underutilized government asset for other purposes due to oversupplies in the market, such as supporting social programs or asset granting to the local government. This regional-based analysis might need to be accommodated in the asset optimization tools such as Highest and Best Use (HBU) Analysis.

Andar Ristabet Hesda - KPKNL Surakarta